Risk Management

Risk Management

As the complexity of the business environment and society increases, so does the number of unanticipated risks and new business opportunities. To ensure sustainable growth, a system capable of preventing and managing risks in advance is necessary. Acknowledging risk management as a crucial management activity, Hyosung has established a risk management system to minimize direct or indirect negative environmental and social impacts resulting from the company's business operations. In order to respond to stakeholders' increased interest in non-financial risks and to fulfill our corporate social responsibilities, we also enhance the management of risks that may arise from non-financial perspectives, such as environmental and social factors, in addition to traditional financial risks.

Risk management system

Hyosung identifies and manages market uncertainty and internal and external risks and opportunities with a significant impact on business operations, and we revised relevant process regulations in 2.02.1 to enhance company-wide risk management capabilities.

Classification of 2 risk types

Hyosung classifies risks into financial and non-financial (business continuity and management) and defines major risks based on their impact and likelihood. For major risks, we establish a preventive system to enable preemptive response by identifying the cause of occurrence in advance. We update the risk management status annually and determine if the objectives of the countermeasures for major risks have been met.

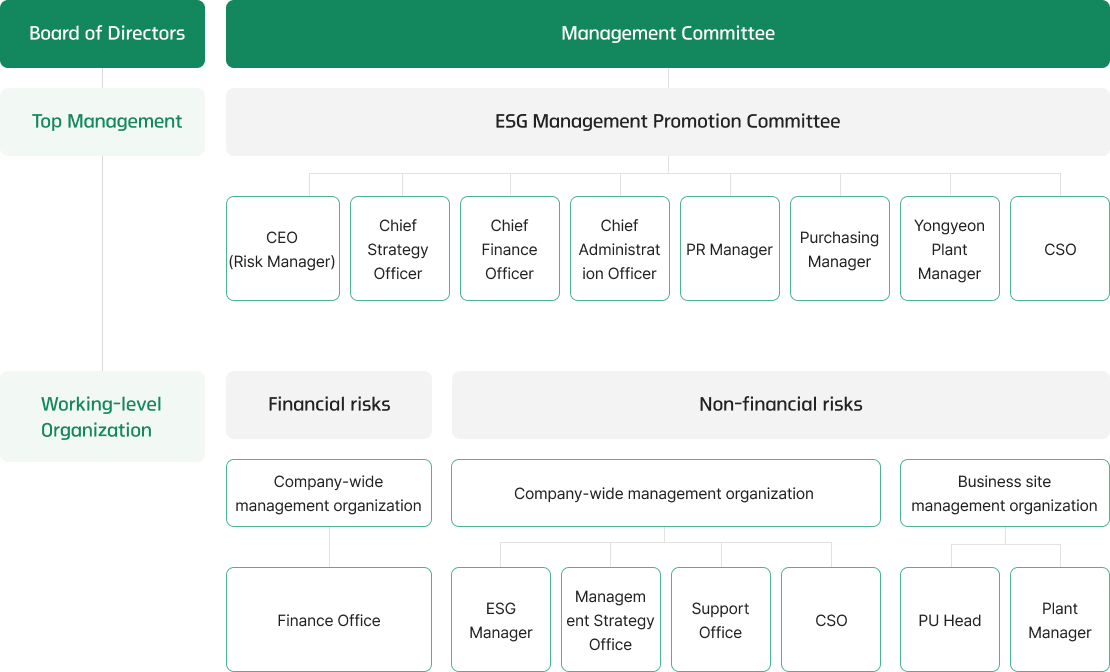

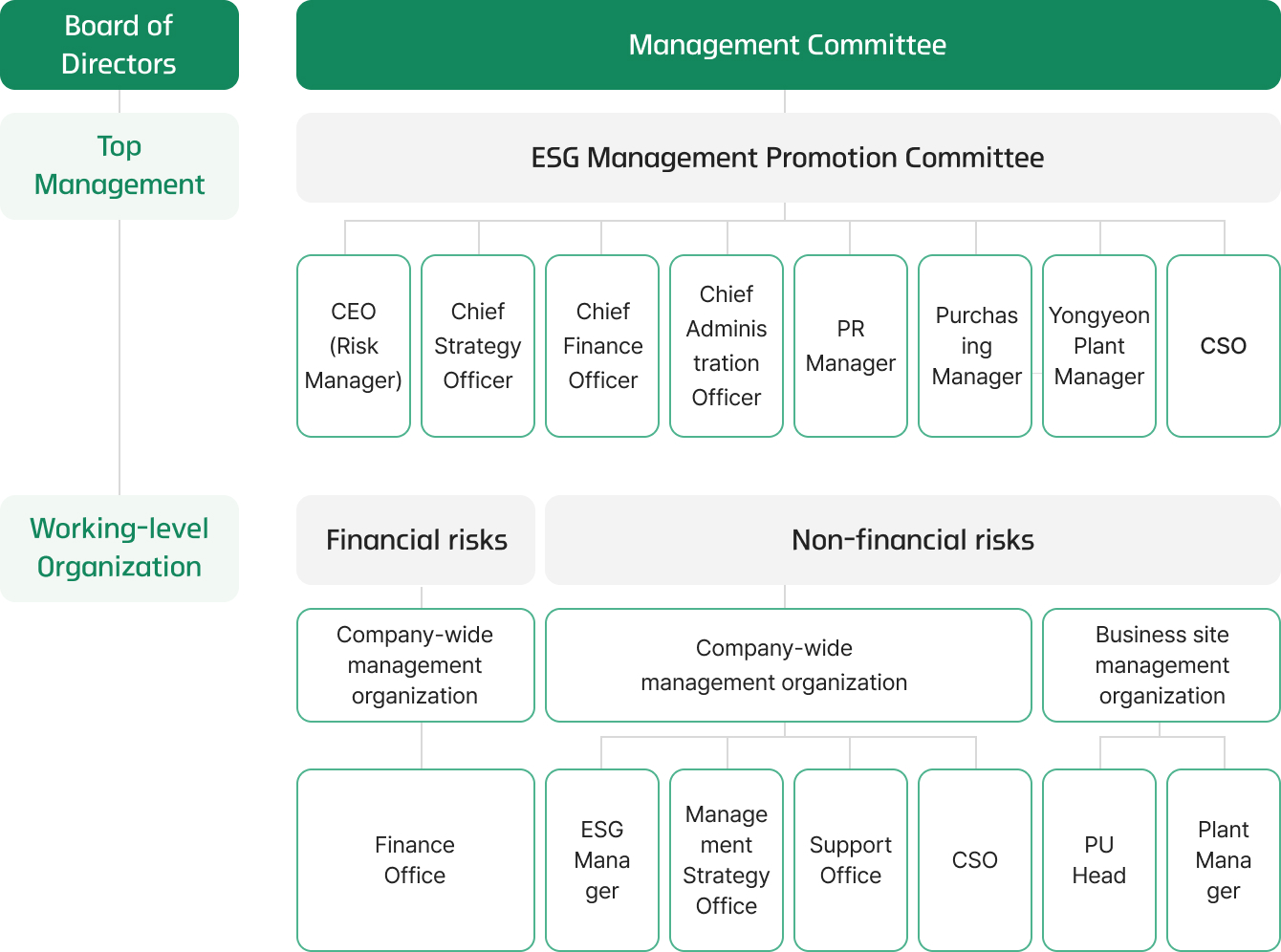

Chemical risk management organization

Hyosung Chemical’s Risk Management Committee under the Board of Directors and ESG Management Promotion Committee under the CEO discuss risk matters and address key risks and response strategies. Additionally, the ESG Management Promotion Committee, chaired by the CEO and comprising the Head of Management Strategy, Head of Finance, Head of Support, Communications Manager, Procurement Manager, Yongyeon (Ulsan) Plant Manager and CSO, manages enterprise-wide financial and non-financial risks. Financial risks fall under the jurisdiction of the Finance Department and in close cooperation with business units within the headquarters and domestic and overseas subsidiaries, periodic measurement, assessment and hedging of financial risks are carried out. Non-financial risks are managed through a cross-functional risk management organization led by the ESG Management Team under the CEO, the Management Strategy Division, the Support Division, and CSO, along with the operating units led by PU leaders and plant managers. These units address practical aspects of risk management related to environmental, safety, supply stability, orders, operations and litigation risks.

|

Risk management process

Management of risks in accordance

with the major types

| Classification | Details of risk | Management activities | |

|---|---|---|---|

| Financial | Market | Market risk associated with financial variables like stock price, interest rate, and exchange rate fluctuations |

|

| Credit | Risk that a client or counterparty will not fulfill their contractual obligations |

|

|

| Liquidity | Risk of sustaining a financial loss due to an unforeseen decline in liquidity |

|

|

| Classification | Details of risk | Management activities | ||

|---|---|---|---|---|

| Non-financial | Business continuity | Supply chain | Risk of product delivery delays resulting from insufficient raw material supply and production continuity |

|

| Disaster and safety | Risks associated with natural disasters such as earthquakes and fires, or workplace safety incidents |

|

||

| Environment | Risk of legal sanctions and fines if environmental regulations, such as GHG and hazardous substance emissions, are disregarded improperly |

|

||

| Classification | Details of risk | Management activities | ||

|---|---|---|---|---|

| Non-financial | Management | Climate change | Regulatory risks, physical risks, and business transition risks related to emissions |

|

| Quality management | Risk due to changes to 4M (Man, Machine, Material, Method), risks impacting continuous supply or delivery, and risk of occurrence or leakage of nonconforming products |

|

||

| Human rights | Human rights violation risk and human resource management risk |

|

||

| Security | Risk of data leakage due to cyber terrorism or data leakage |

|

||

| Law and ethics | Risk of concluding unfavorable contracts and lawsuits, engaging in unfair trade, corruption, etc. |

|

||

| Reputation | Risk of damaged corporate image from misinformation or negative communication |

|

||

| Marketing ethics | Risk of false, exaggerated, or reduced information in advertising or marketing, or transmission of information that disregards those who are limited in understanding information |

|

||

| Brands/ Trademarks |

Risk of brand or trademark infringement or value loss |

|

||

| Orders | Risk of malicious orders as a result of payment terms, contract clauses, ambiguous specifications, unsecured delivery, civil complaints, local country conditions, etc. |

|

||

| General management | Operational risk caused by personnel or system errors |

|

||